- Services

- Packages

- About us

- Pay

- Instant Quote

- Instant Quote

- Request Callback

- Explore

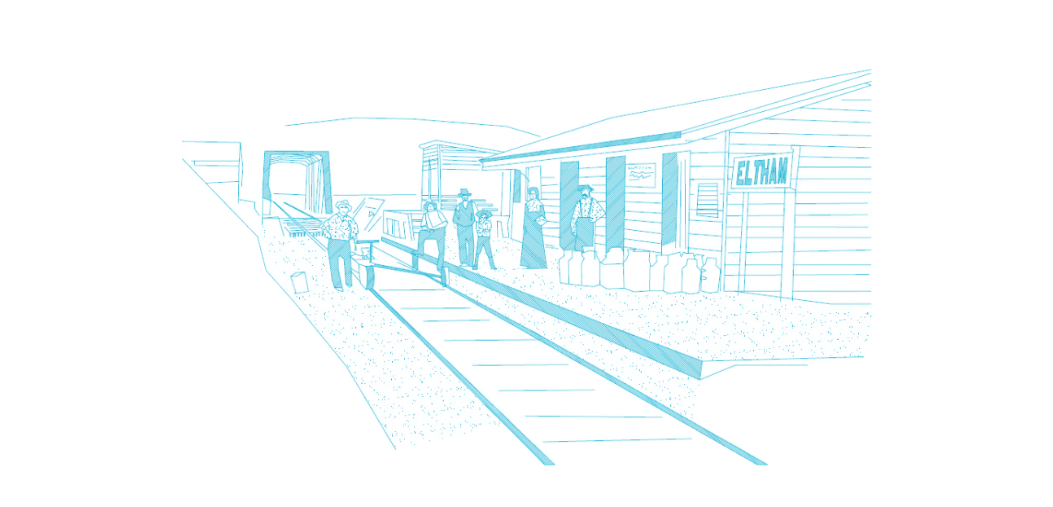

Accountants in Eltham

Eltham is famous for the Montsalvat artist community built as a rustic set of medieval-style buildings in the 1930s. Did you know that 672,890 start ups were found in the UK in 2018/2019 tax year. That’s 1,843.5 per day. Thinking of starting your own set up in Eltham? Why think twice especially when you have our accountants in Eltham to escort you through the entire process. Oh yes. Handling a startup is never easy. It comes with finances, business strategy, accounting, taxes, payrolls, PAYE, and to think we have not even named them all. Yikes!

We comprehend that you need to invest your energy and assets on developing your business. Rather you end up being tied up with routine accounting and bookkeeping. This is something we can accomplish for you. We will initially examine your prerequisites. At that point we will set up the proper bookkeeping methodology and controls. These will keep the accounting and records cutting-edge and in consistence with guidelines. We likewise are consistently accessible to answer your requests with respect to the monetary circumstance of your business.

Everything Done Right

Our accountants in Eltham comprehend your plan of action/money related structure, investigate your records, and offer the correct arrangements. In case you’re nearly losing your benefits, jump on a call with us. Our teams have years of experience in offering accountancy and tax consultation for small business firms, self-employed personnel. Thinking to go ahead with us? Get in touch with us!

Our certified group is totally positioned to care of your business funds and tax. We can set up your VAT returns, compute how much tax and National insurance you owe HMRC, offer you guidance on the most proficient method to limit your business tax by making full and appropriate utilization of your reasonable costs and even handle enquiries from HMRC on your benefit.

As accountants in Eltham, we comprehend your business and as our customer you can reach us for guidance as regularly as you need to. You will be appointed a committed individual in our group and our charges are not just sensible, they are fixed ahead of time and supported by our assurance.

Who we help?

Self Employed

Self Employed/Sole trader Accounting and Taxation Services

Company Setup

Company setup, Registered office, PAYE & VAT registration services.

Startups

Accounting & Taxation Services for Startups & Small Businesses

Contractors

Contractor’s Accounting & Taxation Services operating via LTD

Landlords

Accounting & taxation Services for UK residents Landlord’s

Non-Resident Landlords

Personal Tax Return Services for Non – Resident landlords.

SPV's

Accounting & taxation for those owning properties under SPV's

HNW Individuals

Personal Tax Return services for High Networth Individuals.

How to Join/Switch?

Switching to Cruse + Burke is as easy as ABC...

01

Get in touch

Get in touch, explain your requirements, or sign up online.

02

Letter of Engagement

You will then sign an agreement, either Online on our website or by email.

03

Previous Accountants

We get in touch with your previous accountant to obtain information

04

We Do the Rest

Simply focus on your business and we will do the rest.

Why Cruse + Bruke

The originals of the firm go back to before World War II. There were a number of partnerships over this time, including King & Cruse in the 1970s, part of which became Cruse + Burke in 1992

Technology Driven

We use Xero, Quickbooks, Sage & many other online software.

Dedicated Accountant

Meet, Call, E-mail or Skype to your dedicated accounts manager.

Unlimited Support

Free telephone & email support throughout the year.

Experienced Team

Our team have over 100 years of combined experienced.

Free - Email Reminders

Never Miss any deadline with our automated email reminders.

Yes, We Are Chartered!

We’re an ICAEW, ACCA & AAT accredited Firm.

Ways to get in touch with us