19/05/2021Limited Company , self-employed accountant

Wondering can a sole trader have employees! Of course, if a person wants to expand his business, he/she can hire more people for his business growth. In this short blog, we’ll explore how hiring new employees in sole proprietorship can affect its status and whether your business would be entitled as a limited company after hiring the staff.

Let’s explore!

Do you need to form a limited company to hire employees?

Luckily, No! You don’t need to change your business structure for employing new people. If you’re not willing to change your business from a sole proprietorship to a limited company, you don’t need to. We’re aware of the fact that sole traders run the business on their own, but it doesn’t mean that you need to work alone. Sole Proprietorship means that you are running your business with your name.

You can hire people on a freelance or part-time basis and permanent basis according to your need. However, you need to set up everything correctly.

We’re providing complete accounting and taxation package only at £25 a month and you can make your own custom package here. Get an instant quote right now!

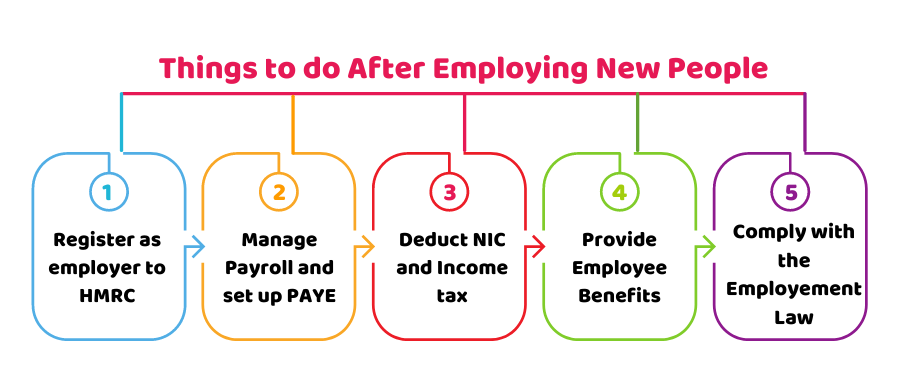

Things to do after employing new people:

If you’re managing your accounting affairs yourself as a sole trader, it’d be a bit of a hassle for you to consider another person in your tax affairs. Though it might be a bit difficult to do it.

However, if you want to save your time and money, feel free to contact us!

After hiring new people into your business, you need to be concerned about the payroll, employer’s NIC and the benefits of employees like sick or maternity pay.

The first things you need to do is to register as an employer to HMRC. You also need to start working on PAYE. By doing this you can deduct the National Insurance and Income tax from the pay of the employees who’re eligible. You need to pay these liabilities on behalf of your employees.

You should make sure to do all the things mentioned to avoid extra charges or penalties from the tax authorities.

Quick Sum Up:

Hopefully, you have got your answer to can a sole trader have employees. If your business is expanding rapidly, it’d be best to upgrade it to a limited company. This is because of the limited liability. You can save a large amount of your money in case of any mishappening and fraudulence by operating a limited company.

Although, a limited company needs more recordkeeping and accounting, yet, it’s hard to be dissolved than a sole proprietorship. As it is crucial to protect your business for the long term.

Want low-cost accounting services, contact our professional accountants anytime!

Get an instant quote right now!

Disclaimer: This blog provides general information about the topic.