07/10/2021Tax Issues , Tax Saving Tips , Taxation

When you start work and fail to provide accurate and complete details to your employer, he will deduct the emergency tax from your paycheck. In addition to that, you will also pay an emergency tax on your pensions. So, read this blog to know how to avoid emergency tax and stop paying this.

Reduce your business burden by letting us manage & record your finances! Our team could help you claim what is rightfully yours! So, Contact us now!

What is an Emergency Tax?

It is a tax that is charged by HM Revenue & Customs to your salary. It is charged when HMRC does not have enough details about your income and tax for a year. The other reasons for paying an emergency tax are as follows:

- If, after being a self-employed person, you have started working for an employer.

- If you have started a new job.

- If you have started getting benefits or state pension.

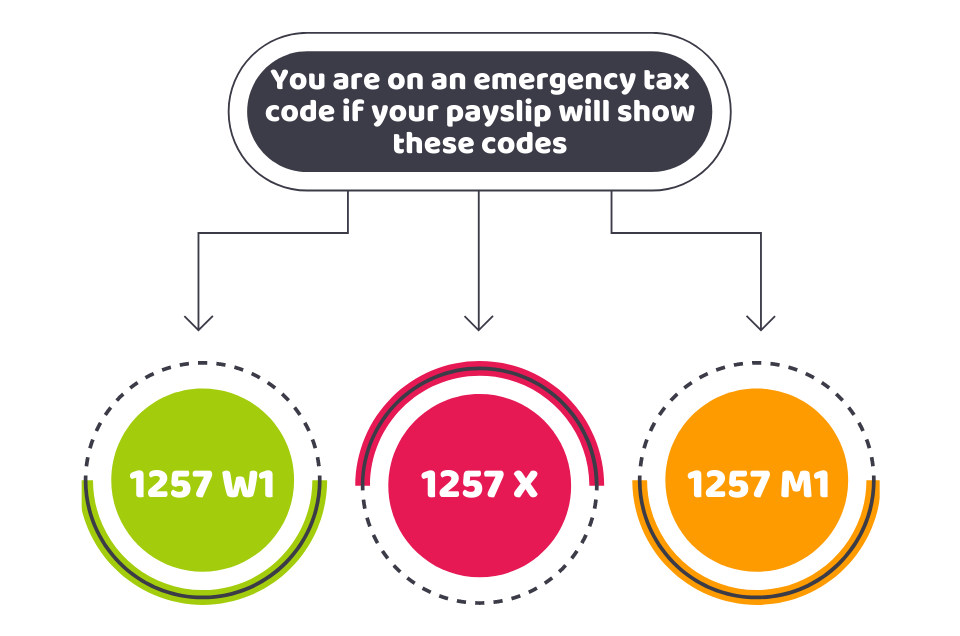

How to Know if You are On an Emergency Tax Code?

In order to know whether you are on an emergency tax code, check your payslips. HM Revenue & Customs will charge you emergency tax if your payslip contains any following tax codes.

- 1257 W1

- 1257 X

- 1257 M1

What is the 1257 Emergency Tax Code?

Within the United Kingdom, almost everyone is authorised to a tax-free personal allowance. It means that a specific amount of your profits is paid to you every year without any tax charged on it. You will be provided with a tax-free allowance which currently stands at £12,570 if your tax code is 1257. It means that you will pay tax on anything above this threshold.

This is because HM Revenue & Customs turned in the personal allowance of £12,570 into this tax code. Therefore, it simply means that you can earn £12,570 before paying tax if you have this tax code.

How to Avoid Emergency Tax?

The simpler way to avoid this tax is to provide a P45 or information about your previous income and tax payments to your employer. This information will tell about your paid tax in the last job to the new employer. Then, he will inform HMRC about these details.

HMRC will send a Pay As You Earn (PAYE) coding notice to provide the correct tax code to your new employer. Then, on the recent payslip, this new tax code will appear from your employer.

In case you do not have a P45, your employer will have to complete a Starter Checklist. This will assist your new employer in allocating a tax code to you that will be forwarded to HMRC.

How Much Will You Pay in the Emergency Tax?

This totally depends on your earnings and emergency tax code. It implies that you will be taxed on anything above your basic personal allowance ( £12,570). Your personal allowance will not be taken into consideration if you have the BR code. You might pay up to fifty percent of your salary as an Emergency tax (the max it can be). Therefore, it is better to prevent emergency tax as you have to pay a high amount of tax.

What is the Method to Prevent the Emergency Tax?

You can stop paying emergency tax by the following method.

- The emergency tax code may imply that you have overpaid tax in the past; in this case, the HMRC will refund any overpayment of tax.

- You can call HM Revenue & Customs directly in case you have been working with your new employer for above three months and still paying the emergency tax.

Final Thoughts

After knowing about how to avoid emergency tax and the method of not paying an emergency tax, we will conclude our blog by saying that HMRC will charge you emergency tax if you fail to provide your new employer with your income and tax details. However, in order to avoid paying an emergency tax, it is crucial to provide these details. You can also claim back overpaid taxes, although avoiding emergency taxes is better.

Turn to CruseBurke for managing finances and for claiming overpaid taxes! We have a team of skilled accountants who will handle everything with HMRC on your behalf. Contact us right away!

Disclaimer: This blog contains general information about how to avoid emergency tax.