09/08/2021Personal Tax , Tax Issues

When a person dies, inheritance tax is levied on the estate that is transferred to the heirs of the deceased by the government. If you’re planning to transfer the ownership of your estate to your children and loved ones without any deductions to get the optimal benefit from your estate, you might be wondering how to avoid inheritance tax. In this blog, we’ll be discussing few ways to avoid inheritance tax. Let’s explore!

Looking for an accountant to work out your IHT? Contact us right away!

What is Inheritance Tax?

This tax is levied on the estate of the person who has died. The estate includes all possessions, property and money a deceased has left. After the death of the person, the executor of the will must work out the estate and duct any liabilities from it. The remaining amount will be entitled as “estate” on which inheritance tax is payable.

What is the Tax-free Threshold of Inheritance Tax?

If your estate is worth below £325,000 (nil rate band) and an extra £175,000 (transferring your main residents to direct descendants). Keep in mind that there is no inheritance tax payable if you are the deceased’s spouse or civil partner even if the estate worth is above the threshold.

Moreover, if you transfer your home to your children (adopted/foster/stepchildren or grandchildren) the threshold of inheritance tax can go up to £500,000.

In addition, if the value of your estate is below the threshold and you’re married /civil partnership, your unused tax-free threshold can be transferred to your partner, at the time of your death. It means they can have a threshold of up to £1 million.

So, it means you don’t need to pay inheritance tax if:

- The worth of your estate is below the £325,000 threshold

- You have left everything above £325,000 for your spouse, civil partner, a charity, community sports club or a political party

How Much is the Inheritance Tax?

Currently, the inheritance tax is charged at a 40% rate on the value of the estate above the nil rate band/personal allowance. But, you can bring it down to 36% if you are donating above 10% to charity in your will.

Example

Let’s say the value of your estate is £700,000 and your tax-free threshold is £325,000. The inheritance tax will be levied with the 40% rate on £375,000 (£700,000 – £325,000)

Calculating your asset and keeping track of everything to find out inheritance tax can daunting and time-consuming. Therefore, you need to talk to our accountants to find out how much inheritance tax you will pay after your death.

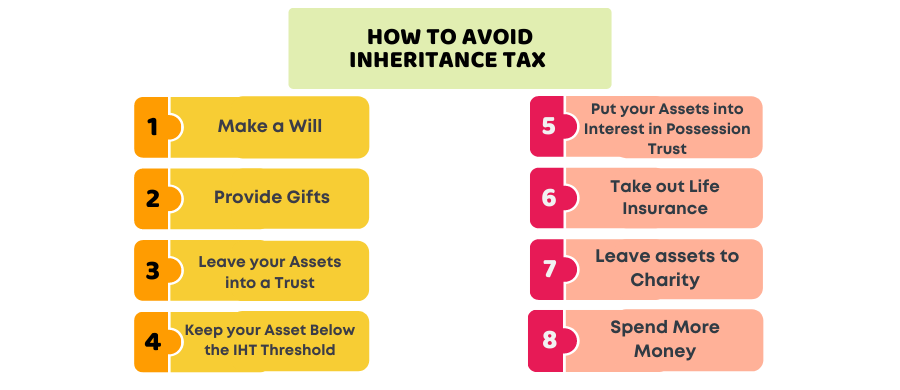

How to Avoid Inheritance Tax?

Want to know how to avoid inheritance tax? There are many ways to avoid or decrease inheritance tax on your estate. The following are the legal and tested ways to reduce or avoid inheritance tax:

1) Make a Will

The simplest way to be saved from inheritance tax is to make a will. By making a will you can mention the people whom you want to transfer your estate after your demise. By doing it, you can better manage and control your estate as per your desire and can minimise your tax. If there’s no will, the government will decide to distribute them as per intestacy rules.

2) Provide Gifts

It is one of the great ways to reduce your inheritance tax. And there is no limit to the number of gifts. But if you give assets away and survive more than 7 years, then you don’t need to pay any tax on any of the assets that you gifted. But if you die earlier than 7 years, your estate will be taxed on a reducing scale.

3) Leave your Assets into a Trust

You don’t need to pay any inheritance tax on the assets that you put within a trust. These assets are IHT free and can be given to your children when they turned 18.

4) Keep your Asset Below the IHT Threshold

Currently, in 2021/22 the inheritance tax threshold known as the nil rate band is below £325,000. This rate is transferable if your estate worth is below it. Additionally, the main residence transferrable allowance is £175,000. It means married couple or civil partners can pass their assets up to one million from IHT.

5) Put your Assets into Interest in Possession Trust

You can earn some interest in your estate by putting your assets into interest in possession trust and can avoid IHT at the time of your death but you have to pay income tax on the amount your receive.

6) Cash out the Life Insurance

By taking out life insurance and putting it into the trust, you can be saved from the potential IHT bill.

7) Leave 10% to Charity

If you provide 10% of your assets to charity, the IHT rate for the rest of the assets will be reduced to 36%.

8) Spend More Money

One of the best ways to stay away from the 40% inheritance tax liability to your beneficiaries is to enjoy life by spending them to their utmost. You can enjoy your money by buying a new car or by going for a world tour, etc. This will reduce your IHT to the nil rate band and you can avoid it IHT.

Quick Sum Up

To sum up, you have got some important tips on how to avoid inheritance tax. By following these, you can leave a great portion of your wealth to your beneficiaries. In addition, you can gift them to your loved one when you’re healthy to remain alive for 7 years to avoid inheritance tax. Moreover, you can spend it yourself or you can donate them to trust to avoid IHT. And there are multiple ways to reduce IHT like providing 10% of your wealth to charity, etc. By following the above tips, you can save a large sum of money.

Still, if you want more tips to avoid IHT, reach out to our accountants for expert advice!

Disclaimer: This blog provides general information on avoiding IHT.