13/08/2021Personal Tax , Tax Issues , VAT

Find out what is self-assessment, who needs to complete a self-assessment tax return, when to submit one and what are the penalties you need to pay for late payments. Let’s delve into the details.

There are over 12.1 million people in the UK that need to fill and submit a self-assessment tax return to HMRC for the tax year 2020-2021.

The deadline to submit a self-assessment tax return online and paying the previous tax bill is 31st January 2022. For paper tax return, it is 31st October 2021.

If you want to register for self-assessment as a self-employed/sole trader, not self-employed and a partner or partnership, you can register on 5 October 2021.

A large number of our clients face problems while registering for self-assessment. Therefore, to make things easy, CruseBurke is offering self-assessment registration services for you to avoid stress and fuss. So what are waiting for click here to register today!

What is Self Assessment Tax Return?

Self-assessment is a system employed by HMRC to work out the tax on your income. Generally, the tax is deducted from your wages, pensions, and savings via PAYE (Pay As You Earn). But if you or your business is getting any income from another source, you need to report it to HMRC by sending a self-assessment tax return.

Who Needs to Complete a Self Assessment Tax Return?

You need to complete a self-assessment tax return to HMRC annually to pay income tax and National Insurance (NI) against your earnings/profit. The tax return needs to be submitted if you:

- are a limited company director or a business partner

- are an employee/pensioner with annual earnings of £100,000 or more

- want to claim tax relief on pension contributions (higher or additional rate taxpayer)

- have earned £10,000 or over from investment income or savings interest

- need to pay capital gains tax from selling assets at a profit

- want to claim child benefit, if your income or the income of your partner is above £50,000

- are the trustee of a registered pension scheme or of someone who has died

- got a P800 from HMRC that shows you have paid less tax than you need to, and haven’t yet paid the due amount

- are a Lloyd’s underwriter

- are a religious minister

Remember that sometimes you need to pay taxes and NI via PAYE and need to complete your self-assessment. For instance, if you receive an investment income and operate a part-time business along with your employment.

Furthermore, limited companies need to file their company’s tax return along with the tax return on personal income.

CruseBurke offers financial and tax consultant services for contractors, self-employed individuals, and limited companies to stay on top of their finances. Work with our tax consultants today to address your tax returns! Contact now!

When will HMRC Send you a Tax Return?

Usually, HMRC will send a return to you if:

- you have earned income without paying tax on it (like income from investment, land, property or overseas)

- you’re a pensioner getting old age relief, though you need to send a short return with fewer details

- your capital gains have exceeded the annual exempt amount (£12,300)

- you were required to fill in a tax return last year

Bear in mind that if you’re already aware of the tax you need to pay, you shouldn’t wait for HMRC to contact you. As it is your responsibility to declare your taxable income. After receiving a tax return from HMRC, you are legally bound to complete and submit it via post or online.

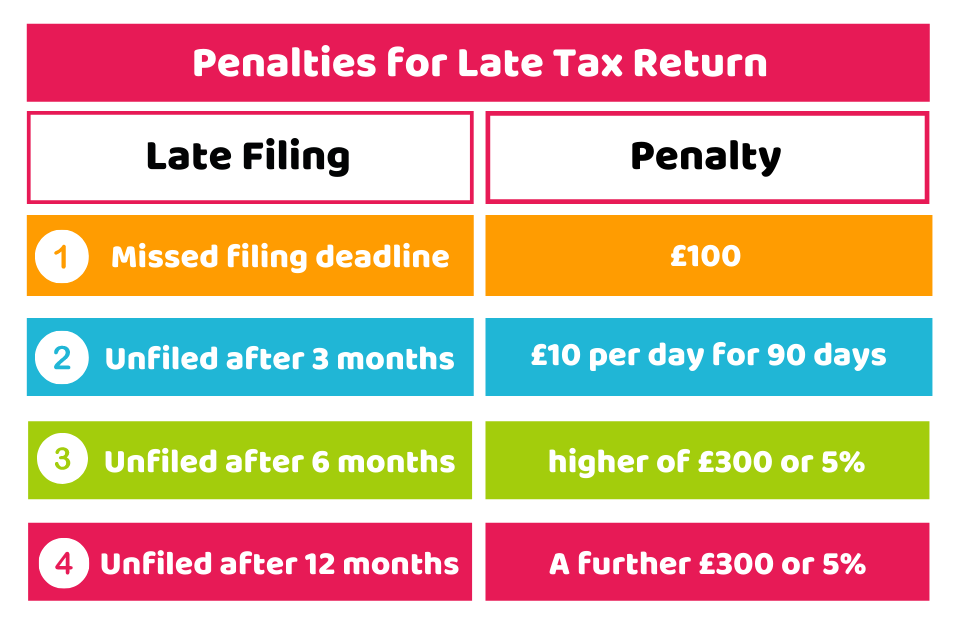

On missing the deadline, you need to pay penalties and may also pay interest on the surcharges on any tax you that you need to pay. The deadline for sending tax returns via post is 31st October and online submission is 31st January.

Penalties for Late Payments

You need to prepare your tax returns before the deadline to avoid errors in the hassle of sending the returns late. You’d be liable to pay interest on unpaid tax and penalties. The standard penalties for sending tax returns late are as follows:

Quick Sum Up

Hopefully, now you know what is a self-assessment tax return, when to pay it to them, who needs to complete a self-assessment tax return, and the penalties for filing it late. Moreover, if your circumstances change like you receive new income from investments or shares, you need to inform HMRC about the changes. As it will affect your tax return.

If you want to avoid paying hefty penalties, feel free to contact our certified accountants for accuracy and efficacy during the process of sending self-assessment tax returns!

Disclaimer: This blog is written for general information on the self-assessment tax return.