26/07/2021Landlord , Tax Issues

Whenever you buy a residential property or land above the SDLT threshold in the UK, you need to pay stamp duty land tax (SDLT) on it. But is Stamp Duty payable on the commercial property too? The answer is yes!

Let’s dive into the details.

Worried about Stamp Duty Land Tax (SDLT)? Get in touch for help!

What is Stamp Duty?

In England and Northern Ireland, SDLT is a compulsory tax that buyers pay on most property transactions. This tax is called LBTT (Land and Building Transaction Tax) in Scotland. And in Wales, it is generally referred to as Land and Building Tax.

This tax is applicable to both freehold/leasehold property and land transactions that are above the SDLT thresholds. You need to report most of the property transactions to HMRC even if you are not paying any SDLT.

How SDLT is Calculated?

You need to pay SDLT based on the purchase price of residential or commercial property as per your tax bands. You don’t need to pay SDLT on your commercial property up to £150,000.

For example, if someone bought a commercial property for £185,000, SDLT is not payable on £150,000 but 2% of it would be payable on the remaining £35,000. The tax depends on multiple factors like the lease term, purchase price, etc.

Remember to send SDLT returns to HMRC and pay the tax due within 14 days of completing the transaction. You can use the government calculator to know how much SDLT is payable.

Looking for a qualified accountant, bookkeeper or tax expert? Get in touch with us right now!

Stamp Duty on Commercial Property

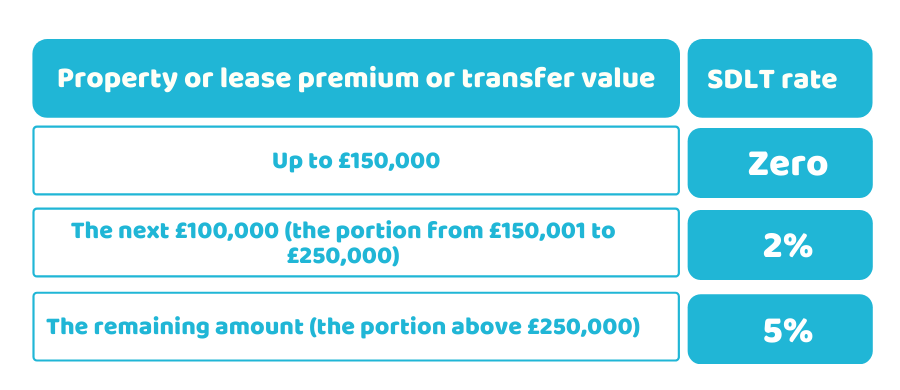

You need to pay stamp duty on commercial property and transfers. Here are the details of current SDLT tax bands and rates:

- For purchases up to £150,000, there is no SDLT payable

- The purchases from £150,001 to £250,000 attract a rate of 2%

- The purchases above £250,000 attract a rate of 5%

If you’re renting a commercial property, the stamp duty is worked out based on different variables that include:

- Length of the lease term

- Annual Rent

- Premium paid for the lease

Rates of SDLT on Commercial Property Leases

If someone buys a leasehold property, he/she is going to pay SDLT on the lease-purchase price using the below rates.

Rates of SDLT on Commercial Property Leases

| Net present value of rent | SDLT rate |

|---|---|

| £0 to £150,000 | Zero |

| From £150,001 to £5,000,000 | 1% |

| Over £5,000,000 | 2% |

Stamp Duty and VAT

If VAT is payable along with the purchase price, then the SDLT is worked out based on the entire sum that is payable on the property purchase. For example, if a property is purchased at £1,000,000 with a VAT of a 20% rate making a total purchase price of £1,200,000. The SDLT would be calculated at the price of £1,200,000.

Consequently, it is double taxation on the buyer of the property, therefore you need to keep this thing in your mind while purchasing a commercial property.

Quick Sum Up

To sum up, we can say that stamp duty on commercial property depends on the price of land or property. If you want to reduce SDLT, you can remove the things included in the property transactions like furniture, machinery, etc. In addition, you need to work out the items that are eligible for a capital allowance against income tax or corporation tax. Furthermore, you can mitigate or eliminate SDLT on large transactions, with the help of a complex SDLT mitigation scheme.

So, it is advisable to take advice from tax experts as HMRC may challenge any reduction done in SDLT.

Want to reduce or eliminate your Stamp Duty Land Tax (SDLT)? CruseBurke has a team of tax experts and accountants for your help, Contact us anytime, we’ll get back to you in the shortest time possible!

For a customized package, Get an instant quote right away!

Disclaimer: This blog provides general information on SDLT.