05/07/2021Accountants , Business , Limited Company

Whether you are struggling to attract new investors, need a loan, plan for the future or intend to sell your business, knowing how well your business is performing in a specific period is imperative for multiple reasons. Turnover and profit are two key indicators to analyze how well your business is performing. Despite having a similar purpose, they are not the same at all.

If someone asks you: is turnover profit? Read on this blog till the end to provide him with a solid answer. Let’s kick off with what are these terms and how they are different.

Looking for a qualified accountant, bookkeeper or tax expert? Get in touch with us right now!

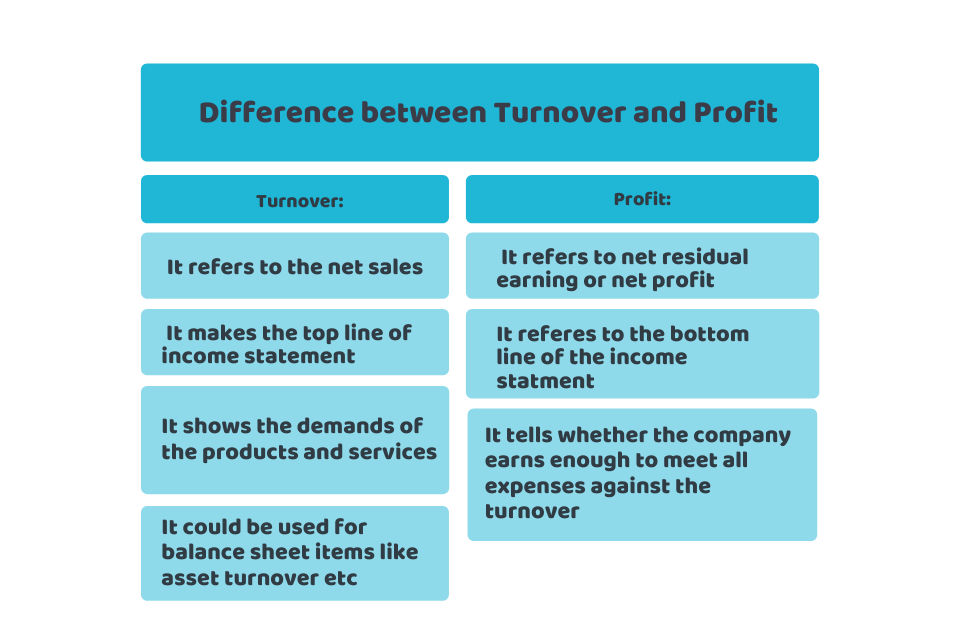

Difference between Turnover and Profit

You might be confused about the terms turnover and profit that seem quite similar, but they are not the same. Turnover is the total income a business generates within a specific period like in a quarter, half-year or a year. On the other hand, profit is the earnings you get after deducting all the costs/expenses. You can measure the profit in two ways: gross profit and net profit. Gross profit is the amount you get after deducting the cost of goods and services. Whereas, net profit is the profit that you get after subtracting all the expenses and taxes.

Turnover

Turnover is more related to the total sales of a company. Whether your business has a single stream of revenue or revenue from multiple sources by various products or services, it’d be considered a turnover. Furthermore, it also reflects the high demand for the company’s products or services in the market. So, high turnover means there is a high demand for the company’s products sold in the market. In this way, a company can charge high prices for their products and services.

Still confused! Reach out to our experts for help!

Profit

The profit indicates the health of your business. It tells you how much amount you’re left with after spending the cost of doing business. It is worked out after deducting all the expenses from the turnover of the company. Consequently, it provides information on different nature of expenses like direct labour cost, material cost, indirect expenses like financial cost etc.

In this way, the profit indicates the residual earnings of the company after deducting all the expenses. This further helps companies to increase the prices of their products or services to earn more residual earning to provide more shares to the shareholders of the company.

Quick Sum Up

One of the two most important parameters to examine business performance are turnover and profit. The easiest way to find out the difference between them is to look at the income statement. As turnover (net sales) are the sales figure that you list on the top of the income statement. It comes at the beginning of the financial statement. Whereas profit (net profit) is placed in the bottom line of the statement. For this reason, we call net profit the bottom line of the business.

Though high turnover or high profit seems lucrative but they don’t guarantee the long term success of the company. Therefore, we can’t consider them the absolute factors for the long-term success of a business.

Toiling to boost your turnover and revenue? CruseBurke has a team of experts for your help, Contact us anytime, we’ll get back to you in the shortest time possible!

For a customized package, Get an instant quote right away!

Disclaimer: This blog provides general information on turnover and profit.