20/08/2021Personal Tax , Tax Issues , VAT

HMRC tax investigation can be a dreadful prospect, especially for the one who has never been through this phase. In the worst-case scenarios, the investigation can take longer duration than normal and its consequences can be stressful. But fortunately, it is rare. The fear of HMRC investigation is natural and understandable. However, this process shouldn’t be that onerous if you’re efficiently handling your accounts. So in today’s blog, we’ll have a look at what is a tax investigation? What are the reasons for tax investigation? What’s its procedure and how long does a tax investigation take? Let’s start!

It is advisable to get the help of a tax expert to avoid a Tax Investigation. Get in touch with us now!

What is a Tax Investigation?

HMRC performs a tax investigation for inspecting the business’s finances to ensure that it is paying its due taxes, both current and of the past. You’re legally required to cooperate with the HMRC tax investigation team and it doesn’t imply that you have made something wrong. If you’re handling your finances with proper care and you’re having a qualified accountant, a tax investigation will not be that daunting and time-consuming.

Reasons for a Tax Investigation

HMRC may investigate the finances of your business for a number of reasons. Taxes can be complex and there are chances of mistakes. But you don’t need to worry if you have made an honest mistake. Here are a few of the common reasons that cause a tax investigation:

- Your business seems a high risk for HMRC

- There’re omission, mistake or unusual activity in your accounts

- There are noticeable inconsistencies between your tax returns like there is a large fall in income

- Your business is frequently filing tax returns late

- Your business is the target area of HMRC

- HMRC is suspecting your business

- You are having an offshore bank account

- Your costs are above the industry norms

- You’re getting income from property

- HMRC gets a tip-off

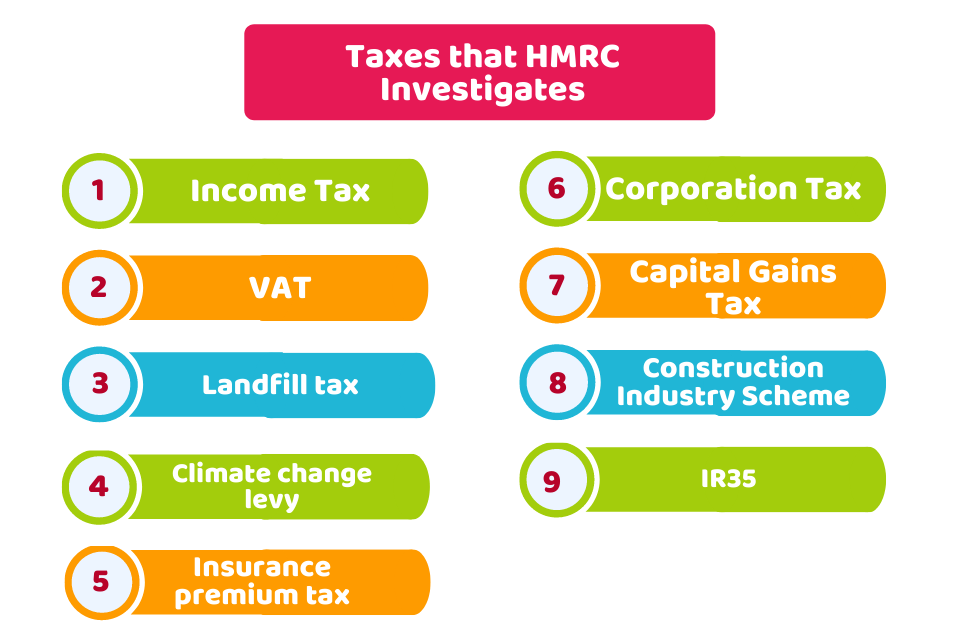

What are the Taxes that HMRC Investigates?

Many people believe that a tax investigation is just about investigating the income tax. But it’s not true. Typically, these are the taxes HMRC can investigate:

- VAT

- Capital Gains Tax

- Corporation Tax

- Construction Industry Scheme (CIS)

- Climate change levy

- Insurance premium tax

- Landfill tax

- Insurance premium tax

- IR35

On the lookout for Tax expert? Reach out to us today for affordable accounting services in Croydon! We provide a wide range of accounting and taxation services to small and medium-sized businesses across the UK!

Procedure of a Tax Investigation

So, how you’d be aware of a possible tax investigation?

Before an investigation, you’ll get a notification from HMRC about the investigation and it may ask you to provide basic information as evidence to support your stance. The data they may ask will depend on the type of investigation they’re performing. You need to provide all the documents to HMRC on time, within 30 to 35 days. Failing to provide the records and data can lead to hefty penalties.

The investigation can uncover all the claims and errors. Afterwards, you’ll receive a letter about the outcome of the tax investigation and the due amount you owe to HMRC. The results may not be correct always. So it’s better to consult a tax accountant before accepting the results.

How Long Does a Tax Investigation Take?

There is not a standard period for a tax investigation by HMRC. The duration of a tax investigation will depend on the investigation level and the paperwork required. This process can take few months, but sometimes it can extend to more than a year or even longer (for complex business structures). In addition, an investigation can be delayed by HMRC to get more information.

It is not possible to predict the time limit of an investigation, but you can minimise its length. Cooperating with HMRC and providing the documents on time can speed up the investigation process. This process can take a long time if HMRC finds something new or hidden. HMRC might ask you to provide 20 years of records in case of underpayment of taxes.

Usually, an Aspect investigation (where a single aspect of a return is inspected) takes up to 3 to 6 months. On the other hand, a Full Enquiry investigation can stretch to a year and more if the case is complex. And the more time it takes, the more costly it becomes.

Quick Sum Up

After discussing how long does a tax investigation take, you might be wondering how to avoid a tax investigation or make it less severe. In this instance, you need to maintain and keep all the records in order from the start of your business till now. The more tax records you have, the better. Bear in mind that if you receive a notice for a tax investigation by HMRC, the tidy and up-to-date financial records will help you to avoid problems during the process. Moreover, it will speed up the process of a tax investigation. A tax specialist can assist you better with what to do when you face a tax investigation.

CruseBurke offers professional services to avoid or minimise the consequences of a tax investigation. Our accountants and tax experts will resolve any problem in your accounts before they turn into big issues that can lead to a Tax Investigation.

Have a query? Contact us today, we’d love to help out!

Disclaimer: This blog provides general information on the above topic.