27/10/2021Business , Business Growth Ideas , Finance

It is important for every company to maintain a good cash flow(CF). If you do not have a good cash flow, it would be difficult to purchase materials, pay salaries, and settle bills. So, when running your company, it is the most crucial thing to look into. Therefore, this blog will let you know:

- what is cash flow?

- How to work it out?

- What can you do to increase your cash flow?

So, let’s start!

Need an accountant to manage your financial affairs, look no further other than CruseBuke! We provide tailored accounting and tax services for you at a reasonable price. Contact now!

What is Cash Flow?

The balance between your company’s incoming and outgoings over a specific time is called cash flow. It includes any current money and the money coming in and going out. But, it does not include investments or assets.

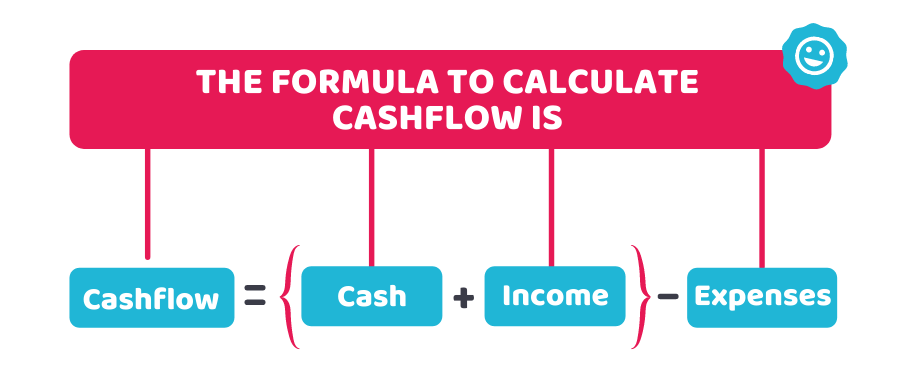

How to Workout Cashflow?

In order to workout cashflow the formula is as follows:

Cashflow= (Cash + income) – expenses

For instance, suppose if you want to calculate your CF for September. In sales, you make £5,000 and spend £3,000 on new stock and other expenditures for that month.

In your business bank account, you had £3,500 at the start of the month. This implies that your companys’ cash flow for September will be £5,500.

Putting these values into the formula to make it understandable:

Cashflow = (Cash + income) – expenses

Cashflow = (£3,500 + £5,000) – £3,000

Cashflow = £8,500 – £3,000

Cashflow = £5,500

Unable to calculate your Cashflow? Let us handle it!

Why is Cashflow Important?

The CF shows the financial status of a company, so we can say that it is like its pulse. Your company will have a positive CF if it has more incoming money than money going out. And, the CF will be negative in case the outgoing money is greater in amount than the money coming in.

A positive CF implies that your company will have money to invest or restock in essential outlays in the coming days. On the other hand, if your company has a negative CF, it implies that your company will quickly run out of cash and not be able to pay for the required things.

Save your time, money, and energy by letting your financial affairs to CruseBurke. Feel free to reach out today!

How can I Increase my Company’s Cashflow?

You can increase it by increasing your company’s sales, minimising its expenses, or doing both. However, in case you want your company to continue improving, you won’t want to minimise your expenses. In addition, without increasing your market investment, you are unlikely to maximise your sales.

It is better to look around for short-term financing in this circumstance—many financing options like merchant cash advances, small business loans, business credits, and invoice financing. Every type works differently and has its pros and cons.

Quick Sum Up

Now that you know what is cash flow and why it is important for your company. We would sum up our blog by saying that it is essential to manage your company’s CF as it directly impacts its growth. Moreover, a positive CF helps to enhance confidence in the company and puts you in a strong place to deal with lenders and get more discounts from suppliers. Therefore, if you can not manage your CF efficiently, then ask an expert to do this for you!

CruseBurke offers affordable financial services! Get an instant quote today!

Disclaimer: This article intends to provide general information based on what is cash flow.