In recent years, after the outbreak and spread of Covid-19 in the UK and across the world, the role of statutory sick pay (SSC) has raised than ever to cope with the financial effects of the pandemic.

Even before the outbreak of the virus, it used to be and is an important entitlement for employees when they are too sick to work. In this blog, you’ll learn what is it, who is eligible to claim it, and how much amount you will receive as SSP. Let’s explore it all in this quick post!

Our accountants at CruseBurke are qualified and cost-effective! We save your time, money, and stress by handling all your finances and business problems in no time! So, allow us to do this at an affordable package!

Statutory Sick Pay (SSP)

Statutory sick pay is the minimum entitlement that UK employees receive if they’re too ill to work and are on leave for over four consecutive days (with the exception of coronavirus). Employers need to pay employees who’re off work due to sickness and qualify for SSP. Self-employed people are not eligible for this pay.

This pay is taken as taxable income and is subject to NICs (National Insurance Contributions).

Who is Eligible for SSP?

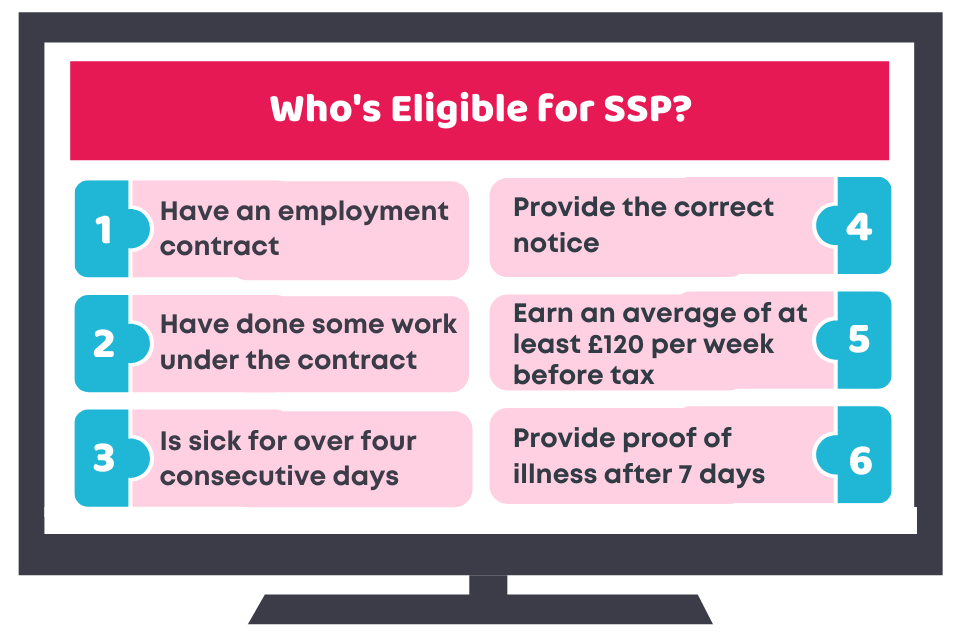

If you are an employee, you can apply for this pay, however, you must:

- Have an employment contract and have done some work under the contract

- Be sick for over four consecutive days (including non-working days)

- Give the correct notice

- Earn an average of at least £120 per week before tax

- Provide proof of illness after a week (7 days)

Those employees who have been paid less than 8 weeks are also eligible for SSP. If employees work for more than one job, they still qualify for this pay.

Note that employees who’re receiving statutory maternity, paternity or any other pay are not eligible for SSP.

At CruseBurke, we have a team of skilled accountants in Croydon who provide solutions to all your business problems! Reach out to us today!

Claiming SSP Due to Coronavirus (Eligibility)

Employees (including ltd company directors) also qualify for this pay if they meet the below criteria and cannot do the job as they:

- Have coronavirus symptoms

- Living with someone who has coronavirus symptoms

- Are notified by NHS or other authorities that they have come into contact with someone with coronavirus

- Stay at home due to a high risk of severe illness from coronavirus

- Are self-isolating as per the advice of a doctor or healthcare professional

Those employees who are self-isolating after entering or returning to the UK and don’t have other reasons for isolation are not eligible for this pay.

The government has said that businesses with employees below 250 are eligible to reclaim SSP for employees who are unable to work due to any of the above conditions. The refund will be up to two weeks per employee and is paid through the Coronavirus Statutory Sick Pay Rebate Scheme.

How Much Amount Employees Receive as SSP?

Your employer will pay SSP in the same ways as normal wages. It can be paid daily, weekly or monthly basis. And your employers will also deduct tax and NI from this pay.

If you are an employee, you are entitled to get £96.35 per week (up to 28 weeks), Statutory Sick Pay (SSP) by your employer, if you’re too ill to work. Your employer might pay more to cover the financial hardship of the employee who’s sick.

Quick Sum Up

Statutory Sick Pay (SSP) is an important entitlement for millions of employees in the UK who’re unable to work due to illness. Now, the government is supporting those people who have been affected by the Covid-19. Bear in mind that you need to pay tax and NICs on this SSP as it is treated the same as your normal salary.

You can get in touch with our accountants to sort out your financial stresses. Talk to one of our Accountants in London about the online accountancy services we provide. We are just a click away! We provide accounting, payroll, and taxation services in affordable packages!

Feel free to contact us!

Disclaimer: This post is intended for general information about the topic.