01/07/2021Business , Business Growth Ideas

Managing the financial affairs of a business can be overwhelming for many business owners. And you don’t need to be an accounting or bookkeeping expert to do it, but you must at least should have the basic knowledge. One of the crucial components of finance is cash flow. So, you need to be well aware of cash flow forecasting to plan for the future growth of your business to keep it afloat.

A cash flow forecast lets you know how much money your business is getting in and how much is going out. With this, you can make effective business decisions about what you can afford and how you can counter future cash flow problems.

Need an accountant to manage your financial affairs, look no further other than CruseBuke! We provide tailored accounting and tax services for you at a reasonable price. Contact now!

What is Cash Flow Forecasting?

It is the process of forecasting or estimating the flow of cash that comes in and goes out from your business at a certain period. Besides, a cash flow forecast helps businesses to predict future cash positions, avoid cash shortages and get returns against the cash surpluses in the best way possible.

Moreover, the finance team of the business bears the responsibility to forecast the cash flow. However, the process requires input from the stakeholders and data sources within a company. Most often, large companies implement this process.

How to Forecast Cash Flow?

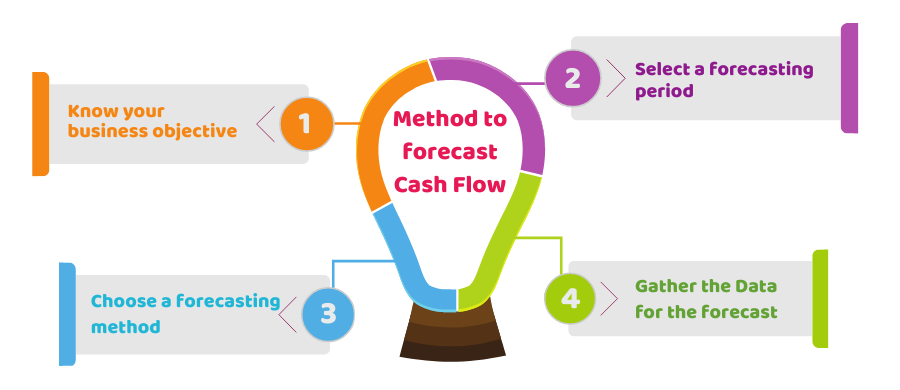

Forecasting the cash flow of a business depends on its objective, requirements of the internal team or investors, and access to the data. Here is the general process that is recommended:

1) Know your business objective

For an actionable cash flow forecast, you need to incorporate it with your business’ objective. Most commonly, it is used for:

- Managing the day-to-day cash

- Interest and debt reduction

- Forecasting future cash level

- Liquidity risk management

- Planning for business growth

Save your time, money and energy by letting your financial affairs to CruseBurke. Feel free to reach out today!

2) Select a Forecasting Period

After determining your business objective, you need to know what future period your forecast will cover. For accuracy, gather the maximum information from multiple sources where possible. For this reason, choosing a suitable period is crucial. Here is the list of some forecasting periods:

- Short-period forecasts

- Medium-period forecasts

- Long-period forecasts

- Mixed-period forecasts

3) Choose a Method for Forecasting

There are two basic forecasting methods: direct and indirect. Direct forecasting uses actual flow data, whereas indirect forecasting uses projected balance sheets and income statements.

4) Gather the Data for your Cash Flow Forecast

Find out the sources where you’ll get the data for your forecast. Generally, you can get the actual cash flow data from the bank account, where you’ll get data of account payables and receivables. In addition, you can take help from your accounting software to get the data. You should seek the following information from these sources:

- Opening cash balance for a specific forecasting period

- Cash inflows for the forecasting period

- Cash outflow for the forecasting period

Advantages of Cash Flow Forecasting

Along with avoiding cash shortages and getting more returns, a cash flow forecast can be advantageous for your business in many ways. Here is are some common advantages:

- Track your spendings

- Determine the future impact of plans and outcomes

- Keep track of overdue payments

- Plans for the cash shortages

- Manage surplus cash

- Help businesses to get out of debts

- Predictive business growth

How we can help

CruseBuke has a team of accountants who can do cash flow forecasting for you. Moreover, we can provide you with a realistic picture of cash by letting you know about your current cash situation. Besides, we can help your business with future financial planning for a prosperous business future.

CruseBurke offers affordable financial services! Get an instant quote today!

Disclaimer: This blog provides general information on cash flow forecasts.