30/08/2021Limited Company , Tax Issues

All limited companies in the UK need to file a company tax return at the right time. In today’s blog, we’ll have a look at what is a company tax return, how to file it, when you need to file it, and what are the penalties for late filings. Here’s all you should know as a limited company owner.

What is a Company Tax Return?

A company tax return (form CT600) is the financial information that includes spending, profits and corporation tax figures reported to HMRC annually. You can also report it to find out how much corporation tax you have to pay.

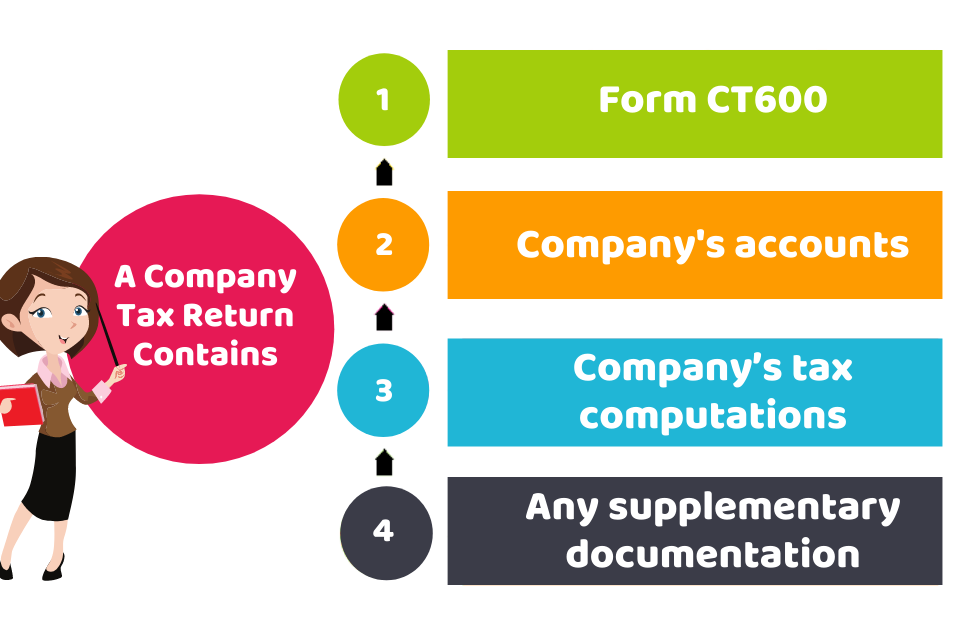

It contains the following documents:

- Form CT600

- Company’s annual accounts

- Calculations of the company’s tax

- Any supplementary documents

If a company received a notice from HMRC to complete a tax return, then a company must do it as early as possible. It typically happens after the year-end. The deadline for filing a company’s tax return is a year (12 months) after the end of its accounting period.

Get inclusive accounting, bookkeeping, tax, and company formation services with our qualified accountants at an affordable rate. Get in touch today!

Filing a Company Tax Return

To file a company’s tax return, you need to ensure that you have:

- Company’s statutory accounts (annual accounts) that are balanced means your total assets should match with your total liabilities and shareholders’ equity

- The government gateway ID and its password. If you don’t have one, you need to create it to use the service

- Your Companies House password and authentication code (in case of filing your accounts together). You can get these when you register with Companies House

You can use the paper form (CT600) if:

- You have a valid reason for not filing online

- You want to file in Welsh

And, you need to complete and post form WT1 to describe the reason behind using the paper form.

To file your accounts with Companies House and the Company Tax return with HMRC. You need to have online account details of HMRC, Companies House online account details, and company registration number. Here is what you need to do as per your situation:

- If you want to file accounts and tax returns together, you can use HMRC’s online service or CruseBurke‘s services

- If you want to file your accounts with Companies House separately, you can send your accounts to Companies House online or Contact us to do it on your behalf

- If you want to file a tax return with HMRC separately, you can use HMRC’s online service or our services to do it

Note: You’ll only need to prepare and file your Company Tax return yourself if you’re fully confident to do it. Otherwise, you might get in great trouble. So, taking the services of an accountant is worthwhile for the accuracy and efficacy of your return.

If you need the help of an accountant or tax expert, contact our qualified accountants at CruseBurke!

Deadlines for Completing Return

To file a return and to pay taxes, you need to follow the below-mentioned deadlines:

- The return needs to be sent to HMRC within 12 months after the year-end

- Any Corporation Tax due must be paid within 9 months and a day after the end of the accounting year

Suppose, a company’s accounting period is ending on 31 December 2019, it needs to pay any Corporation Tax that is due by 1st October 2020 and file the return by 31st December 2020. Generally, these are filed together.

In case of filing them late, your company needs to pay financial penalties.

Penalties for Late Filing

On missing the deadline of the return, you need to pay fines. If you’re:

- One day late, you need to pay a £100 penalty

- Late for three months, you need to pay another £100 penalty

- Late for six months, you need to pay an additional/extra penalty of 10% on your corporation tax bill.

- A year late, you’re levied another 10% penalty on your estimated corporation tax bill

On filing a return consecutively late for three times, the £100 penalty will increase to £500.

Quick Sum Up

So after reading this post, you have understood: what is a company tax return, how to file them, when you need to file them, and what penalties you need to pay in case you file them late. Bear in mind that only limited companies need to submit it. If your company is dormant for corporation tax, you don’t need to submit it. Moreover, sole traders and partnerships also don’t need to submit a return but their earnings are reported to HMRC.

Turn to CruseBurke for preparing and submitting the return and save your time, money, and stress. We have a team of skilled accountants who will handle everything with HMRC and Companies House on your behalf. Contact us right away!

Get an instant quote for a tailored offer at a fixed fee!

Disclaimer: This blog is written for general information on the company’s tax return.