06/10/2021Payroll & PAYE , Personal Tax , Tax Issues

If you are looking for a significant source to know about how to claim overpaid tax from HMRC, then you just have found the right post. First, we will see the P800 tax calculation process of HM Revenue & Customs. This means that HMRC will automatically issue any tax repayment; you don’t have to claim it. But, you will need to make a claim in case you have overpaid tax and did not receive a P800 tax calculation from HMRC.

Continue reading this blog to know more about how to claim overpaid tax from HMRC.

Turn to CruseBurke for managing and recording finances and for claiming overpaid taxes! We have a team of skilled accountants who will handle everything with HMRC on your behalf. Contact us right away!

When can I overpay on Employment Income & Pension Income?

If you get a pension income or employment income and pay your tax via PAYE, you might overpay tax. You can pay too much tax on employment income if:

- Your employer was utilising the incorrect tax code.

- At the same time, you have more than one job.

- Other income which HMRC taxes through your tax code has decreased.

- Your situations changed; for instance, you switched from part-time to full-time work.

- You have a new job, and for a time, you had an emergency tax code.

- You are a pupil who works during off days.

- You ceased working and had no taxable income or benefits for the remaining year.

- For a portion of the tax year, you have worked.

You can overpay tax on pension income if:

- Your taxable income has decreased;

- You had more than one pension (more than 1 source of PAYE income).

- You overpaid tax on a total pension sum.

- Your pension provider was utilising the incorrect tax code;

- Your tax code contains the incorrect amount of state pension.

What is a P800 Tax Calculation?

The HMRC will get details about your total received income, amount of tax paid, and the value of received benefits-in-kind within the tax year from your employer or pension provider. With the help of this information, HMRC will automatically carry out a reconciliation in order to calculate you have paid the correct amount of tax.

You will receive a P800 tax calculation by HMRC if they think you have not paid the correct amount of tax. Therefore, you have to check this calculation carefully because HMRC can have fewer or incorrect details to work out your tax accurately.

In case HMRC thinks you have paid the extra tax, they will automatically issue you a tax repayment; you don’t need to claim it. And, if HMRC thinks you have not paid a sufficient amount of tax, they will write to you which explains how you can repay tax to them.

How to Claim Overpaid Tax from HMRC for the Current Tax Year?

You have to inform HMRC why you think you have overpaid tax before the end of the tax year. You have to tell only if you have paid too much tax through the Pay As You Earn (PAYE) system. You can call HMRC directly to inform them.

You have to gather the following details before calling HMRC:

- Your name, job, address, and NI (National Insurance) number.

- For the current tax year, estimation of your income and pensions from every source.

- Your employer or pension provider details such as PAYE scheme reference number displayed on your payslip, or ask them for it.

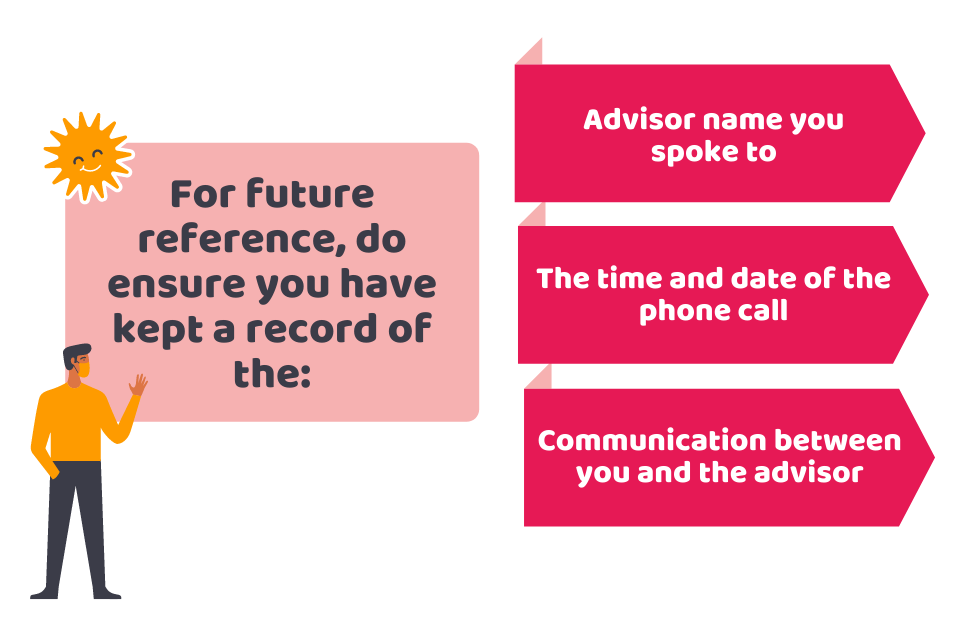

For future reference, do ensure you have kept a record of the following:

- Advisor name you spoke to

- Time and date of the phone call

- Communication between you and the advisor

In order to support your claim, you may have to send some more details. HMRC will let you know about those details if needed. After processing your claim, HMRC will issue you a new tax code. It means if there is any refund, it will be added to your pension or wages, and you will automatically get the amount through the payroll. This will result in a tax refund or lower tax deduction through PAYE.

You might have to claim a repayment directly from HM Revenue & Customs. This is when the refund is due towards the end of the tax year, and you have already received your final salary.

Unable to claim your overpaid tax? Let us handle this!

Conclusion

We hope now you have understood how to claim overpaid tax for the current year. You will have to provide those above-mentioned details and extra details in order to support your claim. Therefore, you should keep a record of your income and paid taxes properly. And, we will recommend you to take help from a professional for recording your finances and claiming repayments.

Reduce your business burden by letting us manage & record your finances! Our team could help you claim what is rightfully yours! So, Contact us now!

Disclaimer: This article intends to provide general information on how to claim overpaid tax.