03/08/2021Pension , Personal Tax , Tax Issues

Knowing how much is your pension lifetime allowance is important, as if you exceed this threshold it’d have hefty tax implications. So, let’s explore what pension lifetime allowance is, how to calculate and protect it. Let’s find out.

Overcome your financial worries with CruseBurke!

What is Pension Lifetime Allowance?

This allowance is a tax benefit that a member can get during their lifetime. Currently, the standard Lifetime Allowance is £1,073,100 for 2021-2022. If the amount of your pension is near £1,073,100, or it is going to reach this threshold by the time you retire, then you must know about it.

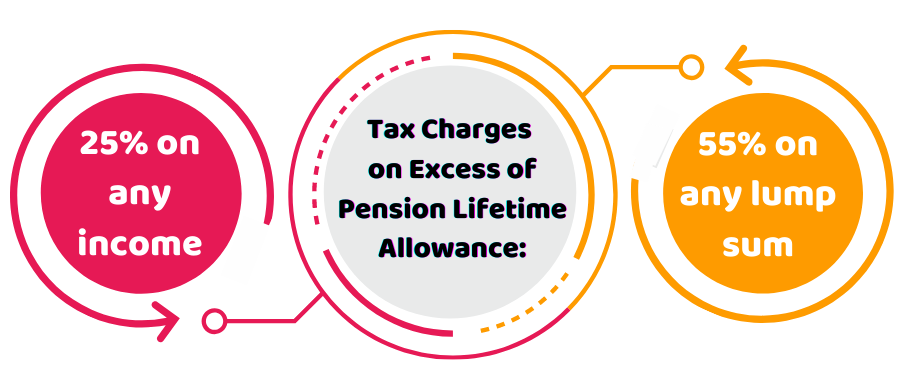

If you exceed the allowance limit, you are required to pay tax on the withdrawal of lump sum or retirement income from your pension. The tax charges on the withdrawal would be:

- 55% on any lump sum

- 25% on any income

This allowance is applicable to all of your pension arrangements that include all personal or workplace pensions like:

- defined benefit pension (final salary)

- contribution pensions (personal pensions)

- any other pension that has paid you an income or lump sum

Bear in mind that this doesn’t include your state pension allowance. If your pension amount exceeds this allowance, it’d be on top of your income tax.

Save with our accountants. Find out how we can reduce your tax burden!

How to Calculate?

Whilst you start withdrawing your pension, the value of your deductions should be recorded on your statements. Although it might not affect everyone, but it is a better practice to work out the anticipated value of your withdrawals in retirement to avoid tax charges. Moreover, it’s worthwhile for the people who own a sizeable pension pot.

Defined Contribution Pensions

Most people will have this pension which will be calculated based on the amount they’ve invested and its performance. This value will be reviewed against your lifetime allowance each time you take out money from your pension.

Defined Benefit Pensions

The value of a defined benefit pension/final salary pension depends on your income and the years you have worked for your boss. You can work out the total value by multiplying your predicted annual pension by 20. If you qualify to get a tax free lump sum, you also need to include it here.

Protecting your Pension Lifetime Allowance

To avoid heavy tax implications on your savings, you need to manage and monitor your pensions closely to make sure you don’t cross the lifetime allowance. You can also apply for protection against the reductions made recently in the lifetime allowance which you can get if you were previously putting aside into your pension with a considerable amount of allowance in mind. There are two types of protection that you can apply:

Individual protection 2016

If your total pension/pensions were over £1m on 5 April 2016, you can go for individual protection 2016. It safeguards your lifetime allowance at your pension value on 5 April 2016 or £1.25m, whichever is lower than the other.

It allows you to increase your pension, but you are required to pay tax on the money you withdraw from your pension that crosses the limit of the lifetime allowance.

Still, you can apply if you have already availed protections like:

- fixed protection

- enhanced protection

- fixed protection 2014

- fixed protection 2016

You are not eligible for it if you are already having individual protection 2014 or primary protection.

Fixed Protection 2016

This protection manages your lifetime allowance at £1.25m but it doesn’t allow you to contribute to your pension. This option is suitable for people who no longer want to save into a pension. Keep in mind that if you keep money into your pension after taking fixed protection, you’ll lose it and need to pay taxes on the excess.

You can apply for this protection if:

- you or your employer haven’t added to your pension since 5 April 2016

- left any of the workplace schemes by 5 April 2016

- already have individual protection 2014

Bear in mind that you are not eligible for it if you’re having primary protection, enhanced protection, fixed protection or fixed protection 2014.

How We Can Help?

If you think you’re reaching near the threshold of pension lifetime allowance, you need to take action right away. CruseBuke can help you to work out how much your pension is worth. We will provide you with clarity on what you have saved and help you to be protected from paying a hefty amount of tax on the excess of your pension.

For further queries, reach out to our accountants for expert advice.

Disclaimer: This blog provides general information on pension lifetime allowance.