04/08/2021VAT

This is one of the most frequently asked questions that we hear time and time again: what is the process of reclaiming VAT on the fuel? Many of our customers are looking for answers regarding VAT on mileage claims. Though reclaiming VAT on fuel is a burdensome process, as you need proper evidence to prove that you have used the fuel for business mileage. Additionally, you are also required to follow the standards of HMRC to reclaim VAT on fuel and petrol. So, let’s talk about the ways to reclaim VAT on fuel and petrol!

Need a VAT Accountant to Reclaim VAT on Fuel, Contact CruseBurke!

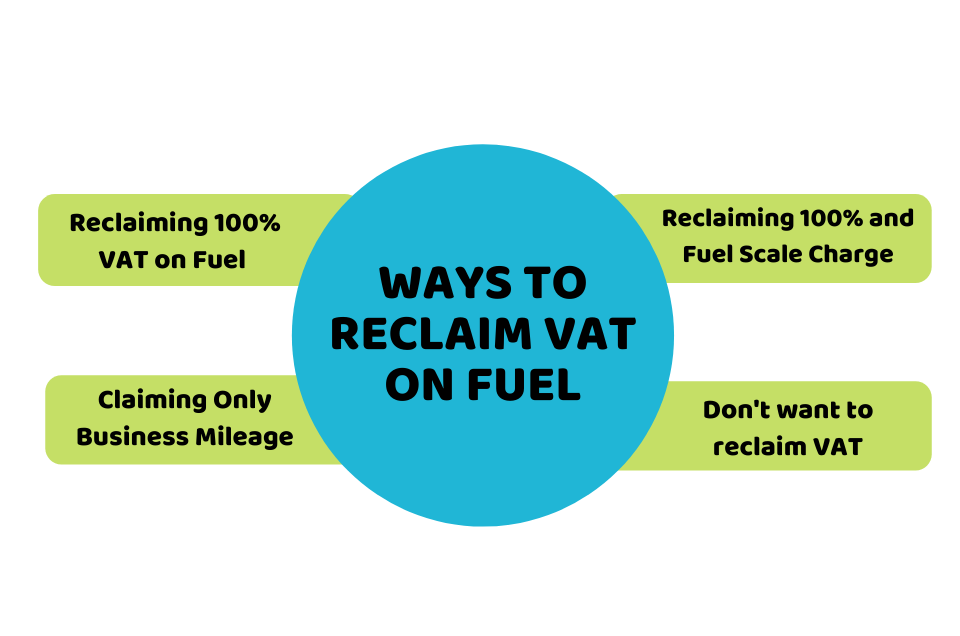

Ways to Reclaim VAT on Fuel

In this blog, we have compiled four ways to reclaim VAT on fuel and petrol for business use. These include:

1) Reclaiming 100% VAT on Fuel

If you have used fuel or petrol wholly for business purposes, you can claim 100% VAT incurred on it. However, here you need to provide evidence to HMRC that you have used it entirely for your business and you have not used it for private purposes. It might be impossible to prove unless you are a taxi firm or a driving school.

2) Reclaiming 100% and Fuel Scale Charge

It is the commonly practised approach by many businesses where the companies provide their employees with a fuel card. With these fuel cards, they can pay for fuel both for personal and business use. It is the simplified way of levying tax on the fuel that is used for private purposes. By paying for a fuel scale charge, you can claim VAT used for business purposes. This charge depends on C02 emissions and the type of car driven.

However, you need to keep in mind that if the business mileage is not up to a certain standard or low, it can be difficult to claim back VAT on it. HMRC auditors can easily identify and check the finance team on VAT reclaim by employing this method. As in many cases, the companies forget to pay/update it when the fule scale charge changes.

Boost your savings with our bookkeepers and accountants. Find out how we can reduce your tax burden!

3) Claiming Only Business Mileage

Another option to claim 100% of business mileage is to claim VAT incurred on the fuel used for business mileage. This implies that you need to keep a proper record of where you have travelled and you also need to have VAT receipts to support your claim. This can be a complex task, therefore you can go for a flat rate claim (advisory fuel rate) for business mileage consumed and reclaim VAT on this amount.

4) Don’t Want to Reclaim VAT

Some businesses prefer not to claim any VAT on business fuel and they cover its cost personally. Generally, it is done if the business mileage is too low and the amount that is going to be claimed is too small. Some people also avoid claiming VAT as it requires proper bookkeeping and recording.

Quick Wrap Up

To sum up, hopefully, you have got enough information on reclaiming VAT on fuel and petrol. Remember that you can claim the VAT (that is not claimed) used for business up to the last four years. HMRC may ask you to provide evidence like receipts, to support and prove your VAT reclaims.

If you are consuming a lot of mileage for business purposes, reclaiming VAT on fuel can save a lot of your money. However, you need to remember that if you make a mistake, it is going to cost you instead. So, it is preferable to take the services of a qualified accountant to keep on top of your finances.

For further queries on claiming back VAT on fuel, reach out to our accountants for expert advice. Get in touch today!

Disclaimer: This blog provides general information on claiming back VAT on fuel.