29/04/2021Limited Company

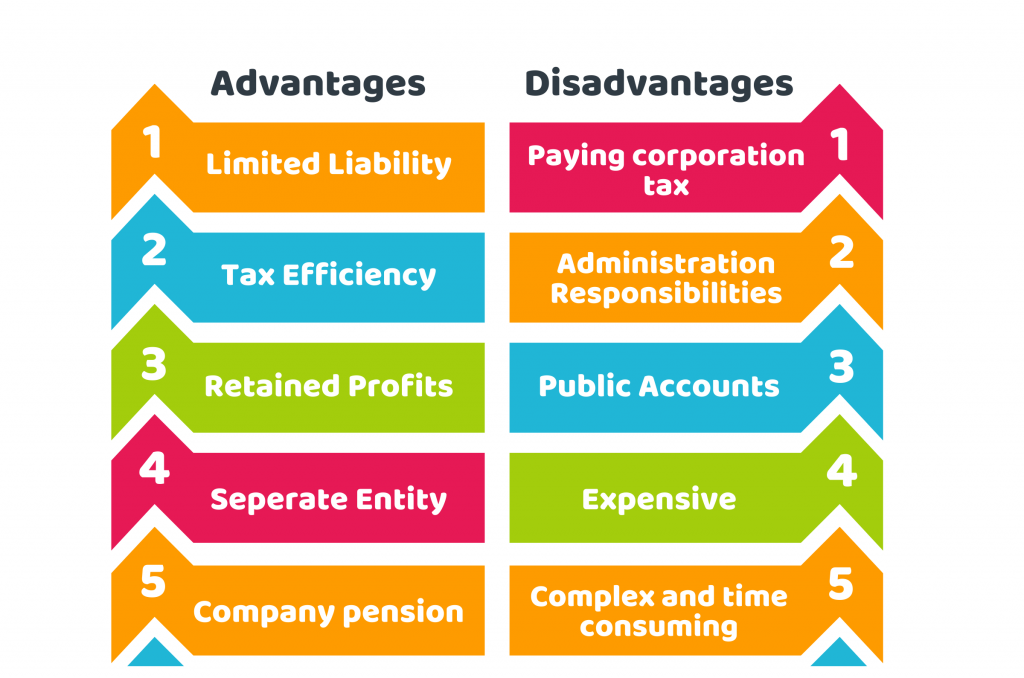

One of the most famous business structures in the UK, a private limited company is limited by shares. But you might be curious to know the advantages and disadvantages of private limited companies. Let’s find out…

Advantages of a Private Limited Company

Following are some of the common advantages:

1. Limited Liability:

One of the best benefits of a limited company is that it’s a separate entity allowing the owner to keep personal possessions separate from the business. This means that they are not subject to their personal liability. In case if your business faces any loss or difficulty, the personal assets of shareholders will be protected against it.

2. Tax Efficacy:

This business type is tax-efficient where you only have to pay 19% of the corporation tax on the profit earned as a limited company. In contrast, sole traders pay 20-45% income tax on their profits.

Reach out to save your taxes.

3. Separate Entity:

A Limited company is a separate entity. A limited company is separate from its owner. Unlike sole proprietorship where the owner and business are considered a single entity, the owner of a limited company is protected against any danger and business failure. Being a separate body, a limited company can enter into a contract and is liable for any business activity.

4. Credibility:

As a limited company, you have to register at companies house to establish its credibility as no other person can use the business name and trademark. In this way, your business can easily be found online. Moreover, a limited company is considered more prestigious and authentic than a sole proprietorship that makes it professional. It can attract large numbers of customers and investors. As a limited company owner, you can easily receive business loans from banks and financial bodies.

5. Pensions:

As an owner of a limited company, you can put in pre-tax into a company pension scheme. Directors can save money through this way and can invest it in a personal pension scheme.

Disadvantages of a Limited Company:

Here are some drawbacks of a private limited company:

1. Difficult and Expensive to set up:

Setting up a limited is more difficult than sole proprietorship. As a sole proprietor, you need to register to HMRC. On the other hand, you need to register to companies house as a limited company. There are more legal responsibilities and documentation than sole proprietorship. You need to pay registration fees to set up a limited company.

2. Administration Responsibilities:

One of the main disadvantages of a limited company is its administrative duties and responsibilities which makes it difficult to operate. On annual basis your company has to file:

- Annual Accounts

- Annual Returns

- Corporation tax returns

- Personal tax returns as a director

This means you have to spend a lot of time and energy on paperwork. However, luckily there are a lot of accountants who can help.

At CruseBurke, we have a team of qualified accountants who can manage the financial responsibilities of your business. Reach out to us now.

You should remember that due to these complex regulations and duties, limited companies are considered respectable and credible.

3. Legal Duties:

As a limited company, there are many legal duties you need to do including running the company, safeguarding the company’s assets and many more. You have to perform all the duties complying with the government laws which makes it more difficult to operate a limited company than other business types.

4. Complex accounts:

Managing the finances of a limited company can be troublesome. You need to record transactions on a monthly basis and sometimes you need to record transactions on a daily basis. Here, you need to keep a record of tax returns, business expenses and need to keep up to date business accounts. Mistakes and errors in business accounts and filings tax returns can cause heavy penalties, therefore you need to contact an accountant for professional services.

Contact us to get affordable accounting services!

5. Public Records:

When you register your business to a companies house, you provide the information of companies’ accounts, shareholders, directors, and records. This information is published by companies house and can be accessed by anyone. This disturbs the privacy of the company, while in sole tradership, your privacy remains safe.

Quick Sum Up:

We have discussed the advantages and disadvantages of a private limited company. Now it’s up to you to decide whether a limited company suits your circumstances and needs or not. Before setting up a company, it is essential to find out its pros and cons to be ready beforehand. And our blog has covered it all. Hope it was helpful.

Can’t find what you are looking for? why not speak to one of our expert accountants in London and see how we can help you are looking for.

For further guidance on setting up a limited company, contact us for help.

Disclaimer: This blog provides general information on the limited companies.