25/06/2021Accountants , Business

Every business needs assets for carrying out its business operations. Whether you’re a technician, doctor, business owner or a company’s director, you need to be well aware of your current assets to efficiently operate your business for generating more revenue. If you’re a new business owner or a veteran looking to polish your accounting skills, you’re at the right place as we will be discussing, what are current asset, how they are classified, how to calculate them and we’ll also see the examples of current assets to get a deep insight into it.

Read on to clear all your ambiguities on current assets.

Get tailored accounting and bookkeeping services for your business with CruseBurke. Contact now!

Current Assets – Definition

Current assets are those assets that can be converted into cash or liquidated within the time limit of one year and they’re listed as the first items on the balance sheet. These assets are the key component of the working capital and the current ratio. These assets help businesses to pay their ongoing and regular business expenses like rent and bills.

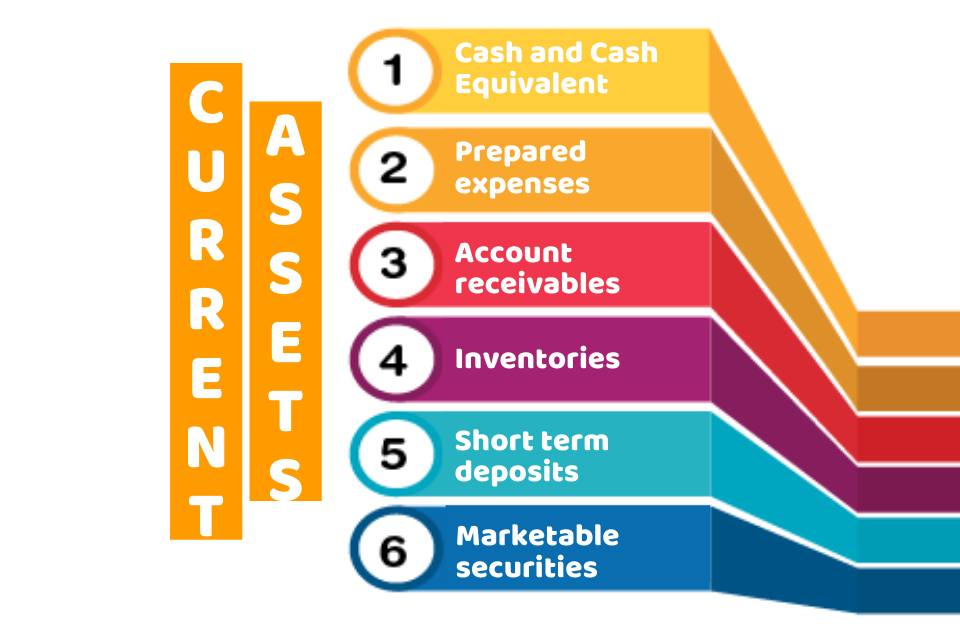

There are many types of current asset including cash, inventory, account receivables, prepared expense and market securities, etc. Current assets are not long-term assets as they can’t be converted into cash within one year. Long-term assets include building, machinery or copyrights.

After discussing, what are current assets. Let’s see how they’re classified.

Classification of the Current Assets

Current assets are included or classified in the assets section of the balance sheet. If we take it broadly, there are five types of financial statement. These are:

- Balance sheet

- Income statement

- Statement of change in equity

- Statement of cash flow

- Notes to financial statement

Current assets are only recorded in the balance sheet. They can be the most liquidated assets and sometimes they can also be the less-liquidated assets. Like cash and equivalent of cash are on the top of the current assets that are easily liquidated whereas inventories and loans come afterwards.

How to Calculate Current Assets?

Calculating the current assets is pretty simple and straightforward. If you’re aware of the basics of accounting, you can easily calculate them through this formula:

Current Assets = Assets – Non-Current Assets

OR

Current Assets = C + CE + I + AR + MS + PE + OLA

Here:

C = Cash

CE = Cash Equivalents

I = Inventory

AR = Accounts Receivable

MS = Marketable Securities

PE = Prepaid Expenses

OLA = Other Liquid Assets

Unable to calculate current assets. Let us know!

Examples of Current Assets

Generally, current assets include cash on hands, cash in the bank, account receivables, inventories, marketable securities and other types of short-term investment. These also include:

- Cash and Cash Equivalent are those current assets that are easily converted into cash. These are cash on hand, cash in bank, petty cash, cash advance and other assets that easily cash convertible.

- Prepaid expenses are also classified as the current asset if the services or goods are expected to be received within the time frame of one year. If not, they’d classified as fixed assets.

- Account receivables are also a current asset that customers are going to pay within the timeframe of one year.

- Inventories are also current assets as they are the stocks that companies hold for their business. It includes raw material, and finished goods etc.

- Short-term deposits are also considered current assets.

All of these need to be recorded in the balance sheet however, some may be put into the income statement when they are sold or used.

Quick Sum Up

To sum up, we have discussed what are current assets, how they are calculated and classified, and what are the examples of current assets. Hopefully, after reading this post you have got a clear idea of the current asset. Remember that balancing the current assets with your liabilities will be helpful for effectively utilizing the finance of your business, raise funds, and meet your day-to-day business goals.

If you are looking for an expert to record, manage and monitor your financial statements, look no further other than CruseBurke. We have a team of expert bookkeepers and accountants for your assistance. Don’t hesitate to get in touch with us.

Disclaimer: This blog is intended just for general information on current assets.