01/06/2021Pension

If you’re a limited company owner looking for a tax advantage, workplace pension contributions are worth considering. These contributions are taken as an allowable business expense and offset against the corporation tax bill of your company.

Besides, as a limited company owner, you have the choice to make personal contributions or through the limited company. Though both can be tax advantageous based on your individual situation, however, you’d likely face the following taxes which we’ll discuss today.

Overcome your financial worries with CruseBurke!

Personal Pension Contributions:

The benefits of making personal contributions are:

- You can get tax relief if you pay the basic rate income tax. It will be automatically be paid from your income. In case of paying a higher rate tax, you can claim additional tax back from your self-assessment tax returns.

- Contrary to limited company payments, you’re not required to validate your payments to HMRC with personal pensions payments.

Along with its advantages, it also has some drawbacks. Though, you can pay 100% of your income into the pension. You cannot raise your salary for the purpose of availing tax advantage.

Suppose your current income is £8,788 and you decided to increase it to £14,000. Your current salary falls into the personal allowance, hence you don’t need to pay income tax and national insurance contributions. You’re only liable to pay dividend tax on the income you receive as a dividend at the rate of 7.5%.

Although, by the rise in salary to £14,000 you’d save more on the pensions. However, you’re liable to pay:

- 20% income tax at the basic rate (2021-21 as personal allowance is £12,500, so you have to pay income tax on £1500, that is £300)

- Class 1 Employees’ National Insurance at a rate of 12% over £9,500, which would amount to £540

Consequently, you have to pay a total of £840. It is the amount that you pay before the workplace pension contribution. You should remember that you can’t withdraw your money from the pension till 55. So, before making the decision, you should be aware of the fact that you are going to save your money for a long time.

Save your taxes with our tailored accounting services! Contact us now!

Pension contributions through the Limited Company:

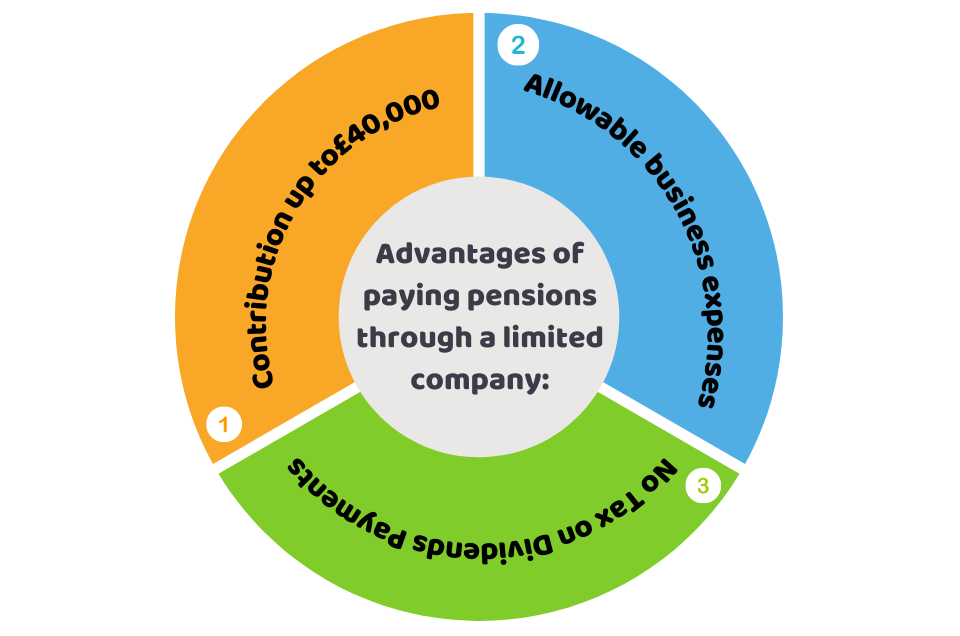

Here are some of the prominent advantages you can get by paying pensions through a limited company:

- The salary threshold (of £8,788) doesn’t apply here, that provides you with the opportunity to contribute for pensions up to £40,000 every tax year

- Your company’s pension contribution is taken as allowable business expenses saving you from Corporation Tax, Employers’ National Insurance or income tax contribution

- Dividends are the most tax-efficient ways to get paid

Quick Sum Up:

If you want to get the flexibility of the payments into workplace pension contributions, you can apply for auto-enrolment exemption from the pension regulator. By paying this pension directly from your limited company you can pay £40,000 per tax year, get exemption from corporation tax, NI and income tax payments. You can save a considerable amount of money by taking your income as a dividend.

For further queries, reach out to our accountants for expert advice.

Disclaimer: This blog provides general information on pension contributions.