03/09/2021Dividend Allowance , Limited Company , Tax Issues

If you are running your business as a limited company, you must pay corporation tax. Limited corporation’s tax rules are different from other corporations to some extent. Therefore, in this blog, you will know the corporation tax for a limited company, how much corporation tax needs to be paid, and what expenses you can claim capital tax allowances.

Are you looking for an accountant to help you manage your finances? Please do not hesitate to contact us! CruseBurke accountants provide tax services at a reasonable cost!

Types of Taxes to be Paid by a Limited Company?

Following are the taxes that need to be paid by a limited company.

- Corporation Tax

- National Insurance Contributions (NICs)

- Value Added Tax (VAT)

In this blog, we will cover corporation tax for a limited company.

Corporation Tax for a Limited Company

If you are running a limited company, you must pay corporation tax on your company profits. The current rate of a corporation tax is 19%. Corporation Tax is levied on a company’s trading profits, the sale of taxes, and investments. When establishing your limited company, you must register yourself for corporation tax with HMRC within the first three months of trading. Late registering may result in a penalty of fees. So, registering for corporation tax must be your priority.

How much Corporation Tax to be paid by a Limited Company?

The rates of corporation tax to be paid by a limited company in 2021 is as follows:

- The “main rate” for the companies, making profits except for ring fence profits, is 19%.

- The standard rate for the unit trusts and open-ended investment companies is 20%.

You can check more information about the rates here!

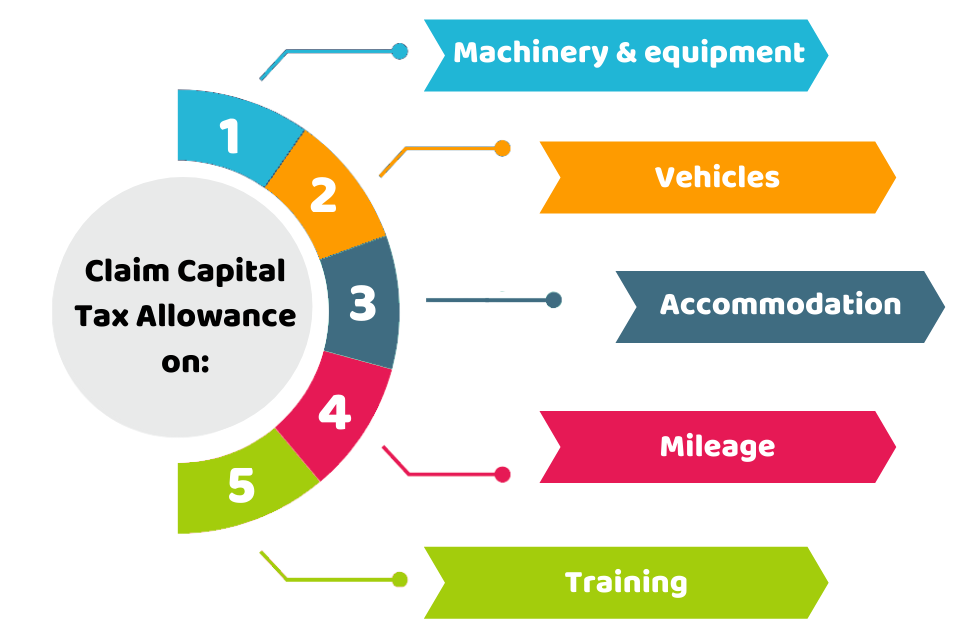

What Expenses are Eligible for Capital Tax Allowances?

When working out how much charge you owe, a few Corporation tax stipends are available for your company. When you prepare your accounts, you can deduct your business expenses from the trading profits before tax. Capital tax allowances can only be claimed on the “entirely and exclusively” expenditures incurred for business purposes. Some costs which are qualified for capital tax allowances are:

- Machinery & equipment

- Vehicles

- Accommodation

- Mileage

- Training

Remember that these expenses must be incurred for business purposes, and you can not claim capital tax allowances for the costs used in entertaining clients.

Dividend Taxation for Limited Companies

In case your local company has made a benefit after taking away trade costs and enterprise charges (corporation tax), it can give out these profits to its shareholders with something called a ‘dividend’. You’ll only pay shareholders a profit (dividend) in case you’ve got good benefits.

Dividends are not charged in the UK, but the shareholders who gain them may be subject to income tax and NICs(National Insurance Contributions) depending on their personal tax allowance. However, when they complete their annual self-assessment, this will become clear.

The tax rates can be changed yearly for limited companies, and it can be troublesome to decide (exactly) what your tax liabilities are. However, you can take help from the tax accounting apps to understand your tax liabilities and manage your finances.

Final Thoughts

To conclude our overview of corporation tax for a limited company, we can see that limited corporations benefit from being exempt from income tax. However, there is no way to avoid corporation tax, NICs, and VAT. You need to pay the corporation tax on your trading profits. Besides this, you can claim tax reliefs on corporation tax. Many tax reliefs are available to reduce your corporation tax bill, such as Research and Development relief, Creative industry tax relief, The Patent Box, Marginal Relief, Disincorporation Relief, etc.

Moreover, you can reduce the corporation tax bill if you make wise strategies about the dividend payments (that directors take from the business) and salary as you can not avoid your taxes, so it’s essential to remain up-to-date about your tax duties while remaining tax efficient.

Unable to claim corporation tax reliefs on your taxes? Let us handle this! We are qualified chartered accountants that can claim your tax relief and manage your taxes in no time!

Disclaimer: This blog contains general information about Corporation tax for a limited company.